World Business Review: Software Problems Facing Businesses Today

Part one of a three-part series

Part one of a three-part series

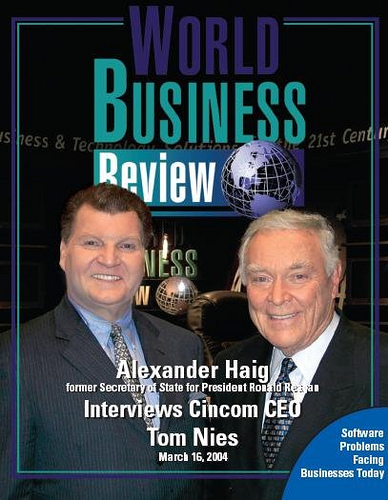

On March 16, 2004, Alexander Haig, former Secretary of State for President Ronald Reagan and currently the host of “World Business Review,” interviewed Thomas M. Nies, CEO and founder of Cincom Systems, Inc., about the issues, challenges and answers for companies struggling with IT purchases and implementations. This three-part series documents the issues explored during that forum.

Haig: Now Tom, the software industry seems unstructured, even haphazard. Information silos don’t often work in harmony and are costly. What’s been the fallout of all of this?

Nies: The fallout is that customers are really sub-optimized. The software industry recognizes this and has two points of view. One is, “let’s trash all this and start all over again.” The other view is, “let’s find ways to integrate, interrelate and insulate ourselves from the past but build a better future on it.” I prefer the second view.

Haig: OK. Then what are the biggest software technology problems that companies experience today?

Nies: Well, the biggest problems are the facts that these systems were delivered way, way over budget, they take too long to implement and they finally underdeliver.

Haig: How can software firms help a company cope with shrinking budgets and an increased demand to deliver more product?

Nies: Software firms have to focus on giving high value to customers at much lower cost, quicker and with much less risk.

Haig: Well then, what do you consider the biggest challenge for a company looking to purchase business technology solutions software?

Nies: I think the most important thing they have to do is to sit down with their provider and say, ” I want this technology delivered at a cost that makes sense.” There was a lot of irrational exuberance in the 1990’s in the financial market but also in the buying of software. A lot of companies made a lot of mistakes and they’re paying a serious price for it now. Today, it’s a buyer’s market.

Haig: What are the key questions that clients should ask a potential software provider?

Nies: Give me your dossier — let me see the successes. Prove to me that you can do what you’re saying and don’t trust the hype of the vendor.

Haig: Good advice now. Can you give us a few examples of the challenges that have been addressed and overcome by your company?

Nies: We’ve done quite a few things that no one else had done in our industry. We have migrated software from one platform to another without conversion — that’s a major problem of the customer. While we integrate data from systems managed by diverse, and non-comparable DBMS, we also insulate the customer from their data so that they can use any type of database systems they want and see the data consistently and compatibly on an integrated basis. We deliver on medium-sized computers — he same type of features and functions that are provided only on the very largest, most expensive computers.

Our customers are looking to increase productivity, profitability and sustainability. And one of the hallmarks of a Cincom customer project is a quick, successful implementation. It’s the very foundation of rapid ROI and long-term profitability for our customers.

We have reams of examples, built on 35 years of success in helping companies increase the performance of their business and achieve their business goals. What’s important to us, and a standard we try to live up to, is that typically, every $1 invested in Cincom returns on the average at least $10 to $20 of economic value for our customer. My estimate is that Cincom customers typically achieve a yield of about $25 to $30 of value for every dollar of software licensed from Cincom.

The Cincom Proof

- Our customers typically reap at least $20 of economic value for every 1 invested in Cincom software.

- Profit improvement of $30 billion to $0 billion on $3 billion investment with Cincom.

The Sustainable Proof

Cincom’s strong historical performance enables us to continue to strengthen our technologies and support to sustain ever-higher ROI for our customers.

- A 47 percent increase in new sales in 2003

- The 19th straight year of revenues over $100 million.

- Over $3 billion in total revenues generated.

Click here to view in PDF Format

Follow

Follow